Building a Grants Calendar Guide

March 30, 2022

[PODCAST] Donor Retention Tips

April 2, 2022Diversifying Your Nonprofit’s Revenue: How You Slice the Pie Matters

We all know the saying “don’t put your eggs in one basket.” It’s good advice, especially from a resource development standpoint. For a nonprofit with diversified revenue sources, the challenges posed in recent years–economic downturn, COVID shutdowns, and in-person event cancellations–were tough but not insurmountable. For an organization that was primarily funded by events, a very small number of major gift donors, one corporate investor, or a single grant, the past 24 months were a huge wake up call. This is where the pie comes in!

How you “slice up” your funding sources, or variety of channels, has an enormous impact on your nonprofit’s future and sustainability. Not only can revenue diversification help you mitigate risk, but an intentional plan for it can allow you to engage new donors (or investors, as we call them) and deepen your current donor/investor relationships.

Revenue Diversification: Taking A Look At Your Nonprofit “Pie”

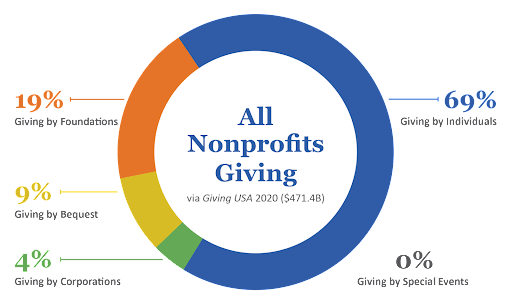

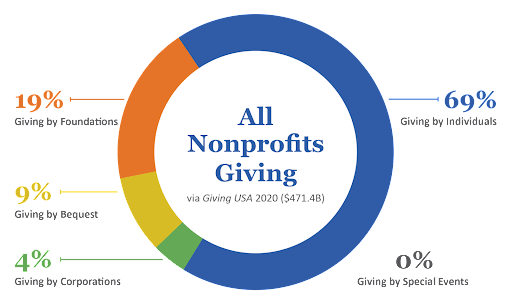

It’s recommended that no more than 20 percent of your income come from any one source besides individuals. The Giving USA’s most recent resource analysis of nonprofits is shown above. What does your nonprofit’s “pie” look like? When analyzing your revenue distribution, be sure to look at the number of gifts within each category as well. Make sure that any one line isn’t too dependent on any one source (for example, your entire Foundation line is one $500,000 grant).

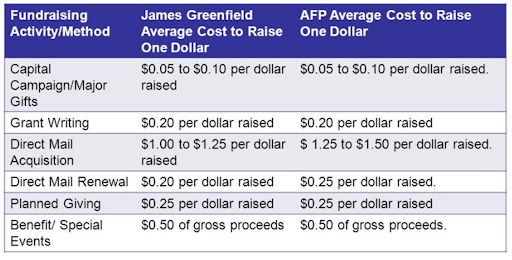

As you evaluate what sources are lower for your nonprofit, look at ROI for each revenue area. In the AFP averages shown below, not every “slice” is created equal. Especially when you consider your staff time and administrative overhead. Major gifts and capital campaigns are inexpensive from a cost-per-dollar-raised perspective, and special events are very costly. There is a trade-off in your time as a nonprofit leader too. You cannot be in all places at once. If you’re raising a majority of your support through special events, then you are choosing not to spend time and effort on major and planned giving efforts.

The good news is that you’re taking the steps to proactively evaluate your revenue sources. Now, you can spend time adjusting them. In this exercise, we find that most nonprofits realize an adjustment could be (and should be) made in the special events area. Golf, galas, and giveaways just don’t provide the same ROI as a capital campaign for multi-year funding commitments. Let’s start there and look at the major funding sources you will be evaluating for your nonprofit:

Pros and Cons of Special Events

On the plus side, special events can energize volunteers and provide fast cash in the door for your nonprofit. They are often a good branding effort to increase your credibility in the community. Special events give your board members and senior staff the opportunity to cultivate existing donors and develop new relationships. Who doesn’t love an evening of dinner and dancing? Or even the virtual silent auctions that grew in popularity quickly?

The biggest issues we see with organizations that rely heavily on event-based giving are the low ROI. In addition, the transactional nature of the giving associated with events can be an issue. Turning donors into long-term, multi-year investors is not a practice built at one gala or golf tournament. It’s also extremely rare to see six- and seven-figure donations come out of these events.

Doing away with events altogether is not the goal of a revenue diversification plan. Instead, as you’re evaluating the events in your plan for this year, you should consider attaching concrete goals to the events you do want to keep. Too often, the goal is just to “raise money” or “communicate the mission”. More specific goals will help events become a solid part of your resource development plan. For example, you may set a goal to engage a certain number of new investors at the event. Or your goal could involve achieving a certain percentage increase in net profits over the previous year.

Revenue Diversification & Endowment Building for the Future

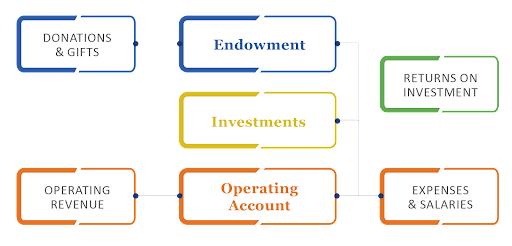

An endowment is a pool of funds which is invested and provides returns or ongoing income to a nonprofit, either for a designated purpose or for general operating support. This channel of funding is perfect for funds that will grow for future use and sustainability. There are a few caveats in this area though, including fees charged annually to manage the endowment by a bank or professional fund manager and potential restrictions on the use of the assets.

A positive aspect of an endowment fund is the long-term thinking associated with it. Building assets to fund sustainability can help any organization. Endowment donors want to leave a legacy and provide for the future of your organization. You can start an endowment with any amount of money, however small. But to build an endowment of any size is a long-term project. You will need to cultivate donors over time since many endowment gifts come as a result of a bequest when a donor dies.

Provide lots of ways for people to make their donations. Be sure to explain how you plan to recognize them or what benefits they will receive.The guidelines and policies you create on how the endowment operates should answer specific questions, including:

- How much do you want to come from your endowment?

- What is your plan to use the fund and its earnings?

- How much of the interest can be employed yearly and when the endowment principal can be tapped if needed under extraordinary circumstances?

Capital Campaign and Major Gift Fundraising

Increasing your time investment in major gift fundraising includes donor identification, qualification, and research first and foremost. A capital campaign is a proven fundraising technique for bringing in major gifts to support a defined plan–this can be bricks and mortar construction or renovations, but often it’s for programmatic expansions or even general operating expenses to help an organization get one step closer to sustainability.

The first step of a capital campaign is a feasibility study. This is the key to a successful campaign, and it serves the same purpose as major gift fundraising initial efforts: identification, research, and qualification for your donors. In addition though, a good feasibility study uncovers opportunities for improvement in your plan, goals, and outcomes. Ensuring that you are communicating what we call Investable OutcomesTM is critical, and the study will test these with prospective investors. They will want to know not just how their investment will help your organization, but also how it will help them and the community at large.

In a capital campaign and major gifts fundraising effort, you will want to assess an investor’s capacity, concern, and connection. This is done by evaluating the individual or corporation’s capacity to give, connection to your nonprofit, and concern with your mission and outcomes now and in the future. You need to have a dollar goal for every investor and continually assess whether you are doing what needs to be done to realize that goal.

All interactions with major investors should be strategic and move the relationship toward a gift. They should also be tracked in your donor/investor database. Make sure you keep good records for future outreach efforts or campaigns.

Enjoying Your Dessert

You’ve looked at your resource development “pie.” You identified areas for improvement in your funding channels and made a plan for success. You can now sit back and enjoy as the increased support rolls in and your nonprofit flourishes. Right? Well, sort of!

Hopefully your adjustments do help improve your overall funding and put you on the path to sustainability. To ensure this, you need to be ready to re-evaluate your revenue diversification each year. What works now may not work in 12 months, as we all saw in 2020. Be proactive and schedule planning meetings annually to look at revenue sources and their performance. Make sure your pie has the right slices, and your nonprofit will have sweet success for years to come!

The post Diversifying Your Nonprofit’s Revenue: How You Slice the Pie Matters appeared first on Nonprofit Hub.