The NANOE Fundraiser Asks For Major Gifts – Louis Fawcett

June 12, 2019

6 Reasons To Pay Board Members

June 19, 20192018 Charitable Giving Soars Thanks to Tax Reform

I purchased an advanced copy of Giving USA’s 2018 Charitable Giving Report THREE MONTHS AGO. I couldn’t wait for it to arrive and have spent hours reading it’s findings. Here’s what I’ve discovered:

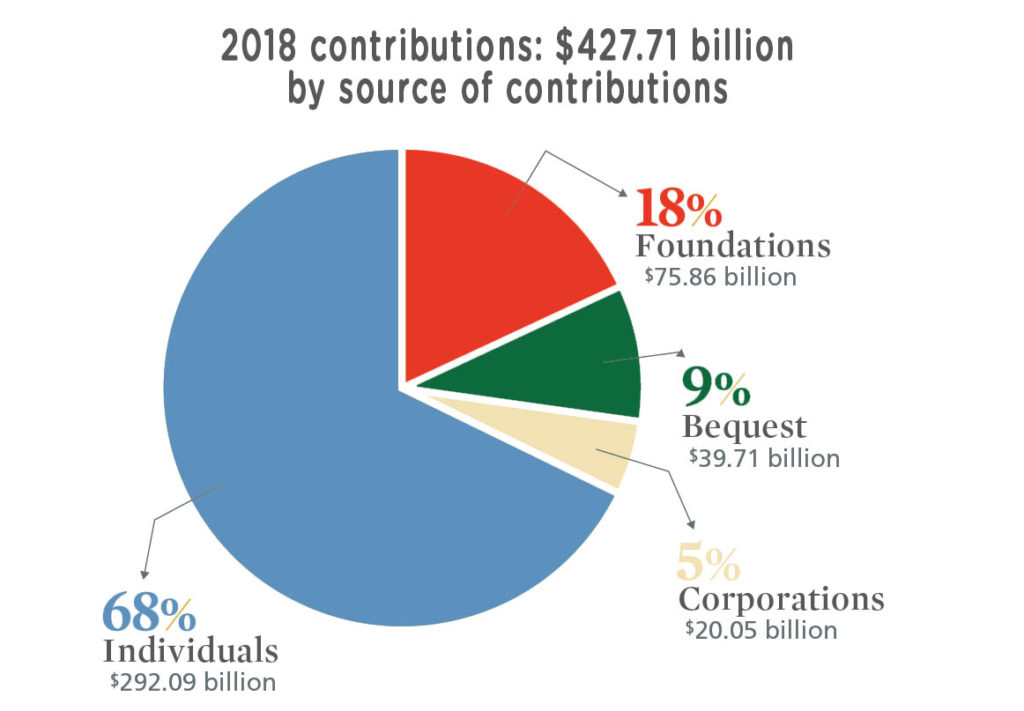

2018 Charitable Giving, generously shared by a spectrum of Americans, BROKE ALL PREVIOUS RECORDS totaling $427.27 billion (up from 2017’s $410.02 billion) as predicted by my article one year ago What Tax Reform Means for Charity: more Money, Money, Money. Here’s what’s so disturbing. Do you remember all the “Henny Penny” news articles written last winter about how tax reform would eviscerate 2018 charitable giving? Do you recall all the “Chicken Little” writers insisting that the nonprofit world would come to an end because of tax reform? “The sky is falling…The sky is falling!”

Well, they were wrong. THEY WERE REALLY, REALLY WRONG.

Why did 2018 charitable increase? It’s simple…PEOPLE HAVE MORE MONEY. Why do people have more money? The Tax Reform and Job Cuts Act of 2017

Take a look at Giving USA‘s analysis below to comprehend America’s Generosity.

According to Giving USA here’s how 2018 charitable giving compares to 2017:

- Charitable increased from $410.2 billion to $427.2 billion

- Gifts given by corporations increased 1 percent.

- Gifts given via bequests remained the same at 9 percent.

- Gifts given by foundations increased by 1 percent.

- Gifts given by individuals decreased 2%.

Giving USA announced that 2018 charitable giving WENT UP!

Why then are media outlets bemoaning the lie that charitable giving WENT DOWN in 2018?

I’ll tell you why.

BECAUSE THEY KNOW NOTHING ABOUT PHILANTHROPY.

I’m an in-the-trenches fundraiser who recoiled at this week’s “click-bate” misinformation campaign. It’s led by “industry rags” and “bloggers” WHO REFUSE TO ACKNOWLEDGE THAT FREE ENTERPRISE IS PHILANTHROPY’S CORNERSTONE. They fail to comprehend that there’s no such thing as a “corporation.” There’s no such thing as a “foundation.” There’s no such thing as “bequest giving.”

THERE ARE ONLY INDIVIDUALS.

THERE ARE ONLY PEOPLE. (Just like YOU AND ME)

Let me help you get your head around this. Foundations, corporations & estates are financial mechanisms USED BY PEOPLE to make a charitable gift. Here’s the key. Regardless of the instrument there’s someone (or someones) who make a decision to give. Here’s the better question: Why has “corporate giving” GONE UP? INDIVIDUALS at these companies made a decision to give more gifts because of a booming economy. (See my article, “February’s Job Report – 313,000 Jobs Boost U.S. Economy – RAISE MONEY NOW” Why has “foundation giving” GONE UP? INDIVIDUALS at these foundations made a decision to make more donations because the stock market increased the value of their financial portfolio. Why has “bequest giving” remained stable? INDIVIDUALS who past-away held stocks, property and cash within their estate during a time of great American financial prosperity.

The notion that 2018 Charitable Giving is down is a lie! DON’T BUY INTO THE RED-HERRING. Let me put it this way. Would you rather have more gifts OR more money? WHO CARES IF THE ACTUAL NUMBER OF GIFTS DROPPED SLIGHTLY WHEN THE TOTAL AMOUNT OF MONEY GIVEN INCREASED TO A RECORD HIGH?

It’s also important to note that Giving USA indicated that ALL OUR CHARITIES GOT THEIR MONEY! Giving USA’s CEO Rick Dunham shared, “The overall composition of gifts remained roughly the same between 2017 and 2018. Gifts to human services (12 percent), health organizations (10 percent), arts & culture organizations (5 percent), international affairs organizations (5 percent), and environmental organizations (3 percent) comprised an equal proportion of overall gifts in both 2017 and 2018.” (There was a small 1 percent dip in giving to religious organizations.)

Simply put, THINGS GOT BETTER. EVERY SECTOR GOT MORE MONEY IN 2018 THEN THEY DID IN 2017!

By the way, don’t let United Way Worldwide fool you. Yesterday, United Way’s Steve Taylor tried to misdirect the public by saying, “There really is no other explanation for these numbers than changes to the tax law,” said Steve Taylor, vice president for public policy at United Way Worldwide. Taylor said he expects the drop in donations to continue as people continue to change their giving habits in light of the new tax law. “This is just the beginning,” he said.”

United Way’s donations numbers are down because their business model is broken not because of tax reform. United Way will continue to diminish as long they attempt to play the outdated community “financial middle-man” instead of re-creating impact in a way that allows them to benefit from this booming economy.

I’ll close with this. You haven’t seen nothing yet. Wait till you see the 2019 report.

Ask me what it’s going to say? Here’s my answer…

…2019 WILL BREAK ALL PREVIOUS GIVING RECORDS AGAIN!

Ask me why all records will be broken…

…The Tax Reform and Job Cuts Act of 2017!

YOU CAN COUNT ON IT.

You’re friend in all this, Jimmy LaRose

2018 Charitable Giving Soars Thanks to Tax Reform was authored by Jimmy LaRose. Jimmy’s passion for “people who give” has inspired philanthropists around the world to change the way they invest in nonprofits. His belief that donors are uniquely positioned to give charities what they truly need – leadership rather than money – is the basis for his work with individuals, governments, corporations and foundations, in the U.S., Europe, Asia & Middle East. Jimmy, in his role as author, speaker, corporate CEO & nonprofit CEO champions all of civil society’s vital causes by facilitating acts of benevolence that bring healing to humanity and advance our common good. Now, in his twenty-seventh year of service, his message that “money is more important than mission” and “donors are more important than people or causes” has resonated with policy institute scholars, social activists, doctoral students, business leaders who rely on him and his team of veterans to meaningfully grow their charitable enterprise. He’s the author of RE-IMAGINING PHILANTHROPY: Charities Need Your Mind More Than Your Money™ written to philanthropists who give nonprofits what they really need…business models that grow capacity and achieve financial sustainability.

5 Comments

Hey Jimmy, you nailed it. Why did Fortune Magazine misrepresent this week’s GIVING USA Report? Here’s just one example of how the media is distorting the truth. “Americans gave less money to charities last year partly because the Republican tax law changes made many people ineligible for tax breaks that can inspire donations. Giving by individuals fell an estimated 3.4%, after adjusting for inflation, last year, according to a report released Tuesday by Giving USA. The numbers reflect the first year of the 2017 tax overhaul that expanded the standard deduction, a simpler way of filing taxes, but also excluded millions of taxpayers from claiming a tax break for donating to charity. Total estimated giving, by corporations, foundations, as well as individuals, fell about 1.7%, after inflation, to $427.7 billion. Individuals account for more than two-thirds of all charitable giving. Increases in donations from corporations and foundations helped offset some of the losses from individuals.

“The environment for giving in 2018 was far more complex than most years, with shifts in tax policy and the volatility of the stock market,” Rick Dunham, chair of Giving USA Foundation, said in a press release. The report is based on data provided by donors, fund-raisers and non-profits.

I liked your explanation and exegesis (there is a word you haven’t used in a while) of the giving trends and I hope you are correct in your prediction for next year. Thanks for keeping me informed.

Numerous credible news source say your charitable giving 2018 analysis is not fully accurate. It’s important to provide a full report of the factors involved in charitable giving if you want to be a responsible organization,

I would like a state by state breakdown.

Do you have a percentage breakdown of which charities/organizations received the charitable donations last year? For example, how much went to an endowment at Harvard versus a soup kitchen in downtown LA?

[…] researched in 2016 (I can’t get the latest report without purchasing it.). But it applies to today, as […]