4 Ways Matching Gift Tools Can Help You Raise More Funds

January 9, 2018

The Age of Boards is Over. The Time of Strong CEOs has Come!

January 9, 2018What Tax Reform Means for Charity: more Money, Money, Money

What Tax Reform Means for Charity: more Money, Money, Money. The recently passed “Tax Cuts & Jobs Act” bill (which I have read in its entirety) is the greatest thing to happen to nonprofits in three decades. Especially for organizations who rely on MONEY to underwrite their programs. Consider the old adage, “there are things in life that are more important than money”, is about as silly as saying “there are things in life that are more important than AIR.” Money, like air, in and of itself is not very impressive, nor does it give life meaning. However, life has very little meaning…IF YOU CAN’T BREATHE. Money is oxygen. Without it, charities asphyxiate, atrophy and fail.

That’s why the recently passed “Tax Cuts and Jobs Act” is important for charities who know that capacity-building is the key to financial sustainability. Let me share you with you three reasons why more Money, Money, Money is about to be infused into the charitable sector.

First, for “Non-Itemizer’s”, the Standard Deduction Doubles…Giving Them More Cash

This one is easy. Small gifts are given from the heart not for tax purposes. These givers have always paid dollar for dollar when making a charitable donation. The “Tax Cut & Jobs Acts“ doubles the size of their standard deduction from $6,350 to a $12,000 for single taxpayers. Likewise, couples filing jointly jump from $12,700 to $24,000! Why is this significant? Because it gives small to mid-size donors more disposable income. They don’t give for tax reasons. These donors will have more money to give to your important mission. How Wonderful…How Marvelous.

Second, for “Itemizer’s”, the Charitable Deduction Increases from 50% to 60%…Giving Them More Money To Give

This one is even easier. 60% is more than 50%. The “Tax Cuts and Jobs Act” not only keeps the charitable deduction intact but INCREASES the limit on cash contributions from 50% to 60% of adjusted gross income when given to charity. There’s a false argument being bandied about that because the standard deduction has doubled less people will itemize and as a result give less charitable dollars. This is patently false, in that, the vast majority of itemizers are upper-middle-class individuals (not super wealthy) and aren’t trying to reach a charitable deduction tax-advantage. They too give from the heart. These donors are the ones who look back each year wondering how much they gave each year and report it accordingly. For donors in the higher-income brackets their CPAs will make sure that they take advantage of the charitable deduction which is now even higher.

Third, Corporate Taxes are Reduced from 38% all the way down to 21%. THANK YOU CONGRESS. Historic…Unbelievable!

The United States has the fourth highest corporate tax rate IN THE WORLD, levying a 38.91 percent tax on corporate earnings. The only jurisdictions with higher rates are the United Arab Emirates, Comoros, and Puerto Rico. The “Tax Cuts & Jobs Act” reduces corporate tax rate from 38% to 21% sparking a boom in business that ultimately lifts their own profits AND PAYCHECKS to employees WHO BOTH CARE & GIVE. Here’s what’s about to happen:

- Corporations will hire more “Non-Itemizers” whose increased disposable income can be shared with nonprofits.

- Corporations will hire more “Itemizers” who will use their increased tax deduction (50% to 60%) for to fund important causes.

- Corporations will have more “Marketing Dollars” to invest in charity. (100% write-off)

- Corporations will have more “Charitable Dollars” to invest in charity. (50% write-off)

It’s already happening. Within hours of the bill passing Boeing declared that they would spend $300 million on “employee-related and charitable investments” because of the tax plan. Wells Fargo announced that they would increase donations to nonprofits and community organizations in excess of $400 million in 2018.

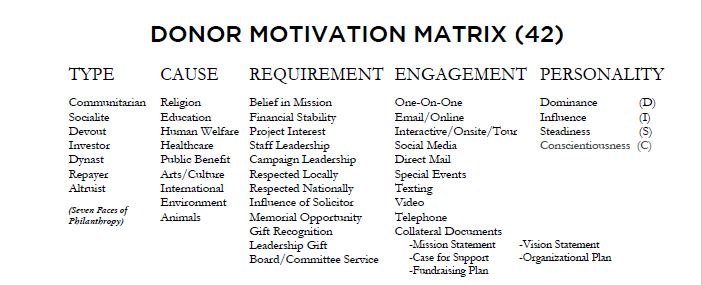

In closing, people donate because they are passionate about a cause. NOT FOR TAX PURPOSES. In a recent survey performed by National Development Institute major donors were asked “why” they give. The the answer “charitable deduction” came up so few times that the term “tax purposes” (as a reason for giving) didn’t even make it into their final report. (See Donor Motivation Matrix below.)

In conclusion, be of good cheer. I’m fond of saying “tax purposes” may be a reason some people give but its never a reason that they give to you. So enter 2018 by presenting donors the gift of a GREAT DREAM backed by a SOUND PLAN. Re-invigorate your CASE FOR SUPPORT knowing that the river of philanthropy is deeper and wider then its ever been and that there will always generous people with even more charitable dollars to invest in your mission.

Happy New Year to You and Yours – Jimmy LaRose

Jimmy LaRose’s passion for “people who give” has inspired philanthropists around the world to change the way they invest in nonprofits. His belief that donors are uniquely positioned to give charities what they truly need – leadership rather than money – is the basis for his work with individuals, governments, corporations and foundations, in the U.S., Europe, Asia & Middle East. Jimmy, in his role as author, speaker, corporate CEO & nonprofit CEO champions all of civil society’s vital causes by facilitating acts of benevolence that bring healing to humanity and advance our common good. Now, in his twenty-seventh year of service, his message that “money is more important than mission” and “donors are more important than people or causes” has resonated with policy institute scholars, social activists, doctoral students, business leaders who rely on him and his team of veterans to meaningfully grow their charitable enterprise. He’s the author of RE-IMAGINING PHILANTHROPY: Charities Need Your Mind More Than Your Money™ written to philanthropists who give nonprofits what they really need…business models that grow capacity and achieve financial sustainability. https://JimmyLaRose.com

27 Comments

Finally! I have read so many articles from charity/non-profit leaders saying the sky will fall on our sector’s head with the cuts. The lies and misrepresentations have been….shocking! So happy to read this article.

Maybe not lies but misunderstandings.

Total Lies, by misrepresenting the obvious.The so-called ‘doubling” of the Standard Deduction is very SMALL. The deduction of $4000 per individual GOES AWAY. So A taxpayers’ standard deduction, whose $4,000 personal exemption goes away completely. Under the old tax code, the standard deduction would be $10,700.Now it increases to $12,000. Do the math. Under the old tax code, standard deduction taxpayers get $6,700 + $4,000, a total of $10,700, an increase of only $1,300 to $12,000, an mere 12.1%. It’s the same for 2 children families, getting a deduction of $24,000, instead of 21,400.This so-called 100% increase in standard deductions is 100% bogus. It’s only a mere 12.1% increase.

It gets even worse for families with more than 2 children. A family of for LOSES $8,000 of standard deductions. The bigger the family, the worse it gets! Any families with 3 dependents/children or more get a stiff INCREASE. The more children, the BIGGER the deduction! Why is nobody writing or reporting on the terrible new law with respect to the working class. I would really like to know why this tax “break is not being reported for what it is, an outright fraud, and another hit on the lower income families, while the rich get lower taxes through lower capital gains and less tax at the expense of the (lower) middle class? Is the American public really that dumb, has everybody forgotten basic math. The new tax ‘break’, and the ill inspired misreporting of it is a total disgrace, nothing less.

The so-called ‘doubling” of the Standard Deduction is very SMALL. The deduction of $4000 per individual GOES AWAY. So A taxpayers’ standard deduction, whose $4,000 personal exemption goes away completely. Under the old tax code, the standard deduction would be $10,700.Now it increases to $12,000. Do the math. Under the old tax code, standard deduction taxpayers get $6,700 + $4,000, a total of $10,700, an increase of only $1,300 to $12,000, an mere 12.1%. It’s the same for 2 children families, getting a deduction of $24,000, instead of 21,400.This so-called 100% increase in standard deductions is 100% bogus. It’s only a mere 12.1% increase.

It gets even worse for families with more than 2 children. A family of for LOSES $8,000 of standard deductions. The bigger the family, the worse it gets! Any families with 3 dependents/children or more get a stiff INCREASE. The more children, the BIGGER the deduction! Why is nobody writing or reporting on the terrible new law with respect to the working class. I would really like to know why this tax “break is not being reported for what it is, an outright fraud, and another hit on the lower income families, while the rich get lower taxes through lower capital gains and less tax at the expense of the (lower) middle class? Is the American public really that dumb, has everybody forgotten basic math. The new tax ‘break’, and the ill inspired misreporting of it is a total disgrace, nothing less.

Awesome, so in sink with the world as one . CHARITY is giving and sharing of two people from the heart! Yeah!

SMALL family America, will love this Charity tax cut/ incentive for big hearted, giving homes.

Probably around Feb/Mar of 2019 we will know who is correct in their assumption. I hope that you are correct the truth is in the numbers.

Wow! Well said. My husband and I itemize our donations. However, the amount we have given has never been driven by trying to get a tax deduction. We give because we believe in the organizations we are giving to and the impact it will make. We itemize because the standard deduction wasn’t high enough to cover the amount we gave. With the standard doubling, we intend to continue to give and definitely will give more . Plus, now we just don’t have to spend the extra hours during tax time to itemize everything. That is a blessing! This is a big win.

The so-called ‘doubling” of the Standard Deduction is very SMALL. The deduction of $4000 per individual GOES AWAY. So A taxpayers’ standard deduction, whose $4,000 personal exemption goes away completely. Under the old tax code, the standard deduction would be $10,700.Now it increases to $12,000. Do the math. Under the old tax code, standard deduction taxpayers get $6,700 + $4,000, a total of $10,700, an increase of only $1,300 to $12,000, an mere 12.1%. It’s the same for 2 children families, getting a deduction of $24,000, instead of 21,400.This so-called 100% increase in standard deductions is 100% bogus. It’s only a mere 12.1% increase.

It gets even worse for families with more than 2 children. A family of for LOSES $8,000 of standard deductions. The bigger the family, the worse it gets! Any families with 3 dependents/children or more get a stiff INCREASE. The more children, the BIGGER the deduction! Why is nobody writing or reporting on the terrible new law with respect to the working class. I would really like to know why this tax “break is not being reported for what it is, an outright fraud, and another hit on the lower income families, while the rich get lower taxes through lower capital gains and less tax at the expense of the (lower) middle class? Is the American public really that dumb, has everybody forgotten basic math. The new tax ‘break’, and the ill inspired misreporting of it is a total disgrace, nothing less.

This article displays gross ignorance (or willful disregard) of the true impact of the tax plan, which will be to devastate programs that benefit people with low incomes, and even many with moderate incomes, making the work of charities that care about the poor THAT MUCH MORE DIFFICULT! I truly doubt, as generous as American donors are, that they will be able to make up for even a sliver of the dollars that are lost to the people that need help the most. I think that this author’s narrow focus on tax changes as they (maybe not, maybe so) affect charitable donations does a great disservice to the truth. I, for one, will not be reading this publication again.

Becky, according to the Wall Street Journal, the Federal Govt spends $80,000 for each poor family of four — so how much gets to the hands of the needy? 30%? Less? Routing the money through DC is NOT the answer, faith-based charity is the answer.

That is not what the Congressional Joint Committee on Taxation says. Hope you are right, but we will see.

I imagine when you wrote up your analysis of how the new tax bill will affect charities you were thinking of big donors, not people of modest income like myself. Here’s how it will affect me. I am retired and living on a fixed income. I don’t spend money on “stuff”. I have enough old stuff to last another couple decades. I don’t waste money either. But I do give a fair amount of money to charity in proportion to my modest fixed income. That is one reason I have always itemized deductions. The new standard deduction will be several thousand dollars less than my usual itemized deductions and will leave me paying an estimated $1,200 more in income tax next year. I will need to take that money from charitable donations in order to pay it. I am already giving the close to the equivalent of my taxable income to charities (after adjustments are figured in). This means itemizing deductions is no longer an option. Net loss for charities–at least $1,200. I can’t imagine I’m alone in this.

S. Benson above is so correct! What a bunch of misleading crap above!

The deduction for charitable giving lives on Schedule A of the 1040 tax from. That means very simply, you need to itemize to get ANY incentive for charitable giving.

With the new caps on Property and State Income taxes, it will make financial sense for almost NOBODY to be itemizing in 2018. Here is the test. Look at your 2017 tax return, Schedule A, bottom line. If as a couple it is over $24,000 it makes no sense for you to itemize in 2018. Let’s take a very basic middle income household in NJ. Home value $350-$400, property taxes $10,000 (not uncommon for states with strong infrastructure, school, healthcare investment), mortgage interest $10,000 and state taxes for 2 income earning family ($20,000). That’s a $40,000 deduction before charities – not capped at $20,000. This family would no longer itemize but take the $24,000 standard deduction. A $24,000 deduction versus $40,000 will result in $16.,000 more income and at least $4-5,000 MORE in taxes.

So

1. The family has LESS disposable income than they did. Not more Jimmy!

2. They also entirely lose the deduction for charitable giving.

If the family actually have more in their pockets, may be losing the deduction will not matter as much. But they are paying $4-5,00 more in taxes in 2018 – as will MOST middle-income home owners.

My advice: give what you can this year, but pout aside 2018 donations into a side account, and look to not give in 2018 and give 2x in 2019 in the hope the Democrats might be able to affect a change to the tax code.

Benson- I am not understanding why you won’t still be itemizing if your total deductions will be over the $24,000 standard deduction? What am I missing?

I’m in the same boat – this Tax Bill is a disaster for me.

S. Benson, you are right. These bozos are just plain wrong; my thinking is that it is typical of the misleading use of numbers by people who don’t work for a living to elicit more from those who do. The entire tax bill was designed and forced through by preservatives chiefly interested in preserving inequity, injustice, and the virtual slavery of most of America. Like you, I will not be making charitable contributions anymore, though I used to be quite generous, because I simply not rich enough to give thousands of dollars to anyone just so as to reduce my own taxable income. Most of my ‘charitable contributions’ have always been unreported anyway, but given the present state of things, where my share of the nation’s wealth, like the shares of wealth of most Americans, took a big hit with the passage of the bill, I am no longer able to afford even that. The preservatives are lining up to attack social security next, following the lead of the arch-preservative Mitch McConnell.

No you are not alone. Some of us are going to lose out one way or the other on these new tax laws. What a shame!

S Benson, you are right on targe. That’s how much more I had to pay on my ALREADY TAXED Social Security benefits!! (grr)

S. Benson above is so correct! What a bunch of misleading crap above!

The deduction for charitable giving lives on Schedule A of the 1040 tax from. That means very simply, you need to itemize to get ANY incentive for charitable giving.

With the new caps on Property and State Income taxes, it will make financial sense for almost NOBODY to be itemizing in 2018. Here is the test. Look at your 2017 tax return, Schedule A, bottom line. If as a couple it is over $24,000 it makes no sense for you to itemize in 2018. Let’s take a very basic middle income household in NJ. Home value $350-$400, property taxes $10,000 (not uncommon for states with strong infrastructure, school, healthcare investment), mortgage interest $10,000 and state taxes for 2 income earning family ($20,000). That’s a $40,000 deduction before charities – not capped at $20,000. This family would no longer itemize but take the $24,000 standard deduction. A $24,000 deduction versus $40,000 will result in $16.,000 more income and at least $4-5,000 MORE in taxes.

So

1. The family has LESS disposable income than they did. Not more Jimmy!

2. They also entirely lose the deduction for charitable giving.

If the family actually have more in their pockets, may be losing the deduction will not matter as much. But they are paying $4-5,00 more in taxes in 2018 – as will MOST middle-income home owners.

My advice: give what you can this year, but pout aside 2018 donations into a side account, and look to not give in 2018 and give 2x in 2019 in the hope the Democrats might be able to affect a change to the tax code.

This article is not accurate. The author did not take into account that the tax law deleted the Personal Exemptions (2017 1040 Line 42. All taxpayers need to be aware that while the standard deduction was raised and appears to be very generous, that it is offset somewhat by the loss of the personal exemption which for 2017 for a married couple was $8100. Thus the new SD (minus the loss of the PE) results in an effective decrease in taxable income of only $3200 over the 2017 Standard Deduction and Personal Exemption combined which totaled $20,800 in 2017. The changes in the tax law were not nearly as generous in terms of the standard deduction as they (and this author) touted it as being and make it harder to have expenses that could have been put on Sched A, including gifts to charity, be deductible. Had they not only kept but raised the Personal Exemptions and left the Standard Deduction the same, donors would have had much more incentive to give as they would have more money in their pocket due to the personal exemption AND the incentive of a tax deduction for charitable giving.

What the article does not mention is that when the Republican Congress raised the Standard Deduction they eliminated the Personal Exemption. So the amount of the income that is not taxable is reduced for a married couple by $8100. While this still results in a modest increase in the deduction it is not as significant as this article implies. And bear in mind that the discretionary income as a result of the raise in SD is not the difference between the former and the new SD amounts. It is the difference in the tax savings. With the change in PE and SD that would amount to whatever their tax bracket is multiplied by difference from 2017 to 2018 which is $3200. So if they are in the 15% tax bracket they have an additional $480.

[…] top ten reasons listed for giving […]

[…] top ten reasons listed for giving […]

[…] What Tax Reform Means for Charity – InsideCharity.org – What Tax Reform Means for Charity: more Money, Money, Money. The recently passed "Tax Cuts & Jobs Act" bill (which I have read in its entirety) is the greatest thing to happen to nonprofits in three decades. Especially for organizations who rely on MONEY to underwrite their programs. […]

if they do not give tax deductibles non profits will be the loser

i they stop tax deductables the non profits will be the loser