Nonprofit Annual Report Guide

January 26, 2022

[PODCAST] Nonprofit Organization Annual Reports: Show Don’t Tell!

January 28, 2022The 2022 Nonprofit Financial Management Checklist

If you’re not a numbers person and are new to keeping tabs on your nonprofit’s financials, a good place to start is here. Take a look at the following six essential nonprofit financial management reports. Make sure you’re familiar with these reports and how to read them. By going over them every month, you can use the data for the benefit of your organization and grow your mission.

Nonprofit Financial Management Checklist: Do You Have These 6 Essential Reports?

1. Statement of Financial Position

The statement of financial position (also referred to as the statement of financial condition) is similar to a balance sheet in a for-profit company. The report’s content is based on an accounting formula:

- Assets = Liabilities + Net Assets

The document is basically a mirror of a for-profit’s balance sheet. However, in a for-profit, the balance sheet lists owners’ equity instead of net assets. The balance sheet is important because, at a glance, it provides you with a clear view of your nonprofit’s financial health. You can quickly see whether liabilities are overwhelming your organization or if you’re in a stable financial position.

2. Statement of Cash Flow

A nonprofit financial statement of cash flow is also similar to the cash flow statement used by for-profit businesses. It includes financing, investing, and operating activities broken down into categories. This makes it easy to see where the cash flowing in and out of your business is going or coming from.

It’s important to keep a close watch on cash flow statements. After all, these documents show you whether you currently have enough money to cover the expenses currently due. While your budget might be balanced overall for the year, that doesn’t mean the timing of money coming in and going out of your nonprofit will be perfectly timed. Cash flow statements help you keep tabs on the timing of your revenue and expenses, so that you always have enough money in the bank to pay your bills, support programs, keep the lights on, and cover payroll.

Want to know the best way to improve cash flow for your organization? Consider a sustainer program. Sustainer programs not only offer your organization a more predictable revenue stream that makes cash flow forecasting a breeze, but they can also bolster your nonprofit with many other benefits. These include improved budgeting and effective planning.

3. Statement of Activities

A statement of activities is the nonprofit counterpart of the for-profit’s income statement. Like the balance sheet, this report is also based on an accounting formula:

- Change in Net Assets = Revenues – Expenses

The statement of activities is important for executive directors to review regularly because it can reveal shifts and trends in your net assets. If they are decreasing over time, this could suggest that your revenue is decreasing, your expenses are increasing, or both. Whatever the reason, any scenario that results in decreasing net assets is cause for concern in a nonprofit. This should prompt careful evaluation, consideration, and action on the part of the executive director and board.

4. Statement of Functional Expenses

In a nonprofit, it’s essential to keep track of expenses for the purpose of budgeting and not over-spending. But tracking expenses is also essential to maintaining a good reputation with nonprofit watchdog organizations and attracting donors.

A statement of functional expenses allows you to meticulously track how your organization’s money is being spent. This helps improve your impact while also operating transparently with respect to the portion of your funds that go to your mission compared to overhead expenses. This statement breaks your nonprofit’s expenses into categories such as programs, direct mail campaigns, education, management expenses, administrative costs, and labor costs. With this breakdown, you can accurately track and report how your organization spends its money.

5. Annual Report and Form 990

Some nonprofits simply use their IRS Form 990 as an annual report. Using this tax document on its own, however, represents an enormous missed opportunity to highlight your impact, market your mission, thank your donors, appreciate your volunteers, and drum up even more support for the upcoming year.

In addition to including official financial reports, your annual report should tell the last year’s story of your organization. Use the document to summarize the previous year’s happenings. First, outline your mission. Then, list your major achievements, significant donations received, overall impact, the people (volunteers and employees) who made it all possible, and your aspirations for the upcoming year.

6. Nonprofit Budget vs. Actuals

Every month, compare your nonprofit’s budget to your actual numbers and take note of any variances. If it looks like you are spending more or less than expected or generating more or less revenue than expected, you will need to make adjustments accordingly. Making minor adjustments each month—rather than one big adjustment at year-end—helps you to operate with your goals always in sight.

Nonprofit Best Practices for Budgeting

Even though it’s not an “official” report since it reflects projections instead of actual numbers, a budget is one of the most important financial tools in nonprofit financial management. It helps you set goals and stay on track while anticipating and planning for potential problems. One way to stay on top of ebbs and flows this year is using a helpful Nonprofit Budget Guide.

Since budgeting is so important for nonprofits, it’s important that you implement sound processes for putting together your organization’s budget. Some of the best practices for nonprofit budgeting include:

- Start early with enough time to gather data, get relevant input from stakeholders, and present your budget for board approval

- Develop an official process for budgeting with a collaborative budget workbook and delegation of tasks to key members of your team

- Take time to evaluate the current context as well as your historic financial data

- Create a separate document where you record the reasoning behind all assumptions you make

- Be realistic about the revenue estimates you include and don’t be afraid to contact past corporate donors and foundations to ask about their plans for the upcoming year

- Keep fixed and variable costs separated in different categories, in addition to operating vs. capital expenditures

- Take time to forecast your cash flow for the upcoming year and consider the timing of incoming revenue and outgoing expenses

- Maintain good bookkeeping records for accurate data

- Don’t forget to include non-monetary contributions so that your Form 990 is accurate

- Take time each month to compare the numbers, as mentioned above

Financial Management for Nonprofits: Always Be Report-Ready With a Back Office Built for Nonprofit Accounting

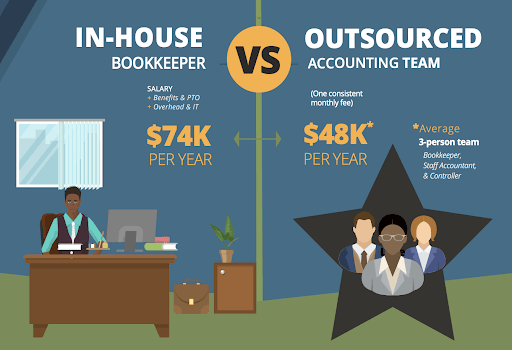

Accounting for nonprofits does not have to put an excessive strain on your nonprofit’s operating budget. Your nonprofit organization can access the expertise of entire teams of bookkeeping and accounting professionals by choosing to outsource your back office function.

View The Full Infographic HERE.

A team of outsourced nonprofit accounting experts can set your organization up with easy access to QuickBooks reporting for nonprofits. In addition, you can access all the fully integrated tools and technology to help you automate your record-keeping processes. These can include expense tracking, time tracking, funds use, and more.

After working in the nonprofit financial management industry for 35 years, I see a difference when organizations use their numbers to make mission-driving decisions. That’s why I started GrowthForce—to serve the overlooked group of nonprofits. With a powerful back office, you can start learning how to leverage your numbers to make data-driven decisions. These decisions can cut costs, generate the biggest ROI, and lead your nonprofit to a healthier, more impactful future.

*This spotlighted blog post is courtesy of GrowthForce

About the Author

From tech founder to nonprofit CFO and fundraiser, Stephen King brings a unique combination of vision, foresight, and experience to help nonprofits maximize their cash flow and operational efficiency. He’s been a dedicated board member of many nonprofit organizations – including seven years working for Amnesty International USA – where he was the Director of Development and Chief Financial Officer. His time at Amnesty reinforced Steve’s life-long commitment to giving back to the community through charitable causes. Regarded as one of the accounting industry’s top thought leaders, he’s currently serving as President & CEO of GrowthForce, a heart-centered company with specialized teams providing accounting for nonprofits. Learn more about GrowthForce by connecting on LinkedIn.

The post The 2022 Nonprofit Financial Management Checklist appeared first on Nonprofit Hub.