Major Donors Answer Fundraising Question: Should My Nonprofit Ask Now?

April 18, 2020

Nonprofit Transformation During COVID-19 – Hall Powell

April 22, 2020Will Nonprofit PPP Loans Replenish This Week? – April 20, 2020

Will Nonprofit PPP Loans Replenish This Week? – Senate Democrats and Republicans have come close to a deal that could inject roughly $370 billion into loan programs for nonprofits and small businesses including $310 billion more into the Paycheck Protection Program (PPP), setting aside $60 billion for rural and minority groups. The remaining $60 billion would go to the Economic Injury Disaster Loan program (EIDL), a separate program offering loans for small businesses. Treasury Secretary Steven Mnuchin told Republicans on a call Sunday afternoon that outstanding issues relating to the bill are limited to increased federal funds for coronavirus testing.

The talks come after the $349 billion Paycheck Protection Program, which offers forgivable loans to small businesses, ran out of money on Thursday. Democrats rejected a proposal to refill the fund two weeks ago. They instead argued for changes, including adding more money to support federal testing, hospitals and local governments. They’ve also pushed to ensure groups without banking relationships get access to the program and SNAP benefits.

Will Nonprofit PPP Loans Replenish This Week?

Mnuchin said on CNN’s “State of the Union” that leaders are “making a lot of progress” and he hopes the deal will be passed in the Senate on Monday, in the House on Tuesday and be up and running on Wednesday.

Rep. Steny Hoyer, D-MD, sent out a note Sunday evening saying “pending agreement” the House could take up the bill as soon as Wednesday.

Small Business Administration is Checking Personal Credit Scores

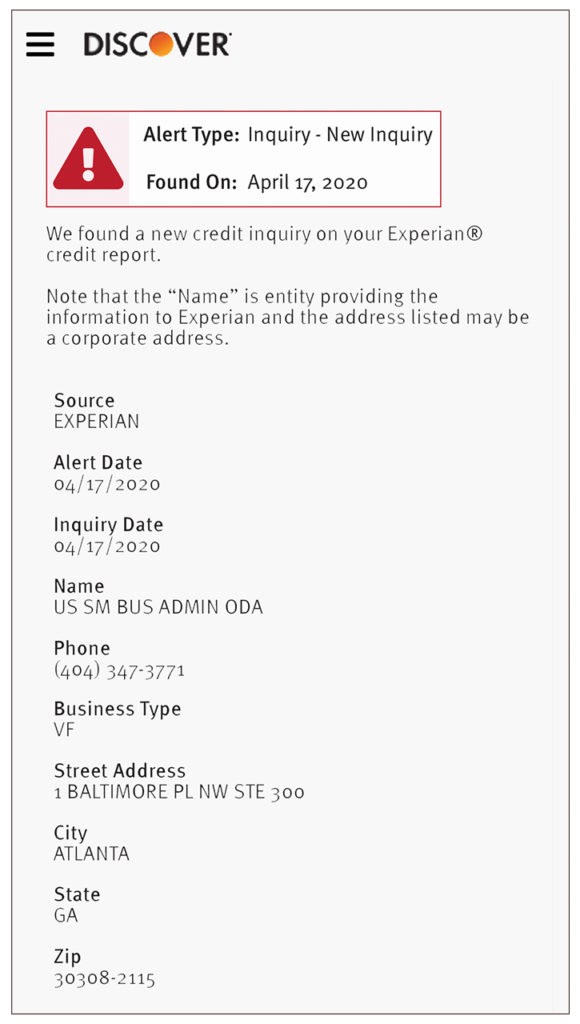

Much to our surprise we received a notice from Discover Card that the Small Business Administration had made an inquiry at Experian as to our personal credit score number. We applied for a PPP Loan as an agent of a nonprofit organization on April 3, 2020. This is the message we received from Discover on Friday, April 17, 2020:

We would like to note that the SBA seems to have made a credit score inquiry not our actual lender. We also found it interesting that despite hearing that the original $350 billion had run out on Wednesday for PPP Loans the SBA was still handling our application on Friday evening.

Treasury Releases Detailed Report As to How the First $350 Billion Was Handled

On Thursday evening April 16 the U.S Treasury released a six-slide PowerPoint Deck named Paycheck Protection Program (PPP) Report sharing details about the the SBA’s performance during the period April 3-16. We discovered information in this document not commonly distributed by media outlets.

44% of the PPP Loans Went to 4% of Requesters

It took only 13 days for loan requests to top $340 billion. That’s impressive. The problem is, a lot of the money went to larger businesses because of, in part, quirks in the way the law was written. And when large businesses—that trade on stock exchanges and have access to traditional debt and equity capital markets—use the SBA PPP, it drains resources from more needy businesses. Over the last few days, there has been a growing backlash over the distribution of the funds. Several media outlets have revealed how large chunks of the package were taken up by chain restaurants, hoteliers and publicly traded corporations, rather than small, local businesses.

What’s more, 44% of the SBA loans went to 4% of loan requesters. That’s about 67,000 applications taking almost half of the resources. There are about six million small businesses with less than 500 employees in the U.S.

74% of PPP loans were for under $150,000, demonstrating the accessibility of this program to even the smallest of small businesses. That’s true, and it’s a good thing, but regulators need to pay attention to the loan size distribution too.

Wells Fargo May Be In Trouble Again

A California-based company filed a class-action lawsuit against Wells Fargo citing unfair actions against some small businesses seeking government-sponsored coronavirus relief under the Paycheck Protection Program. The lawsuit filed on behalf of small business owners on Sunday alleges that Wells Fargo unfairly prioritized businesses seeking large loan amounts, while the government’s small business agency has said that PPP loan applications would be processed on a first-come, first-served basis.

Inside Charity is pleased to report that hundreds of nonprofits have indicated that their loans have been approved. (Few have yet to see funds deposited into their accounts.) Over 400 comments and questions have been recorded at Inside Charity by nonprofit executives, staff, board members, ministry leaders and volunteers over the past ten days. We grateful to everyone who has participated and want to encourage as many as people as possible to continue to share their experiences. Your written comments and contributions have helped your colleagues navigate this process.

Will Nonprofit PPP Loans Replenish This Week? was first posted at INSIDE CHARITY

For more articles like Will Nonprofit PPP Loans Replenish This Week? VISIT HERE

Will Nonprofit PPP Loans Replenish This Week? was authored by Jimmy LaRose. LaRose’s work as an entrepreneur, author, fundraiser, speaker and co-founder of NANOE (National Association of Nonprofit Organizations & Executives) has raised hundreds of millions of dollars around the world for people in need. His best-selling book RE-IMAGINING PHILANTHROPY has been named by BookAuthority as one of the 100 Best Philanthropy Books of All Time.

Will Nonprofit PPP Loans Replenish This Week? and other INSIDE CHARITY content and comments are for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing on this site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto.

9 Comments

The Children’s Museum of he Treasure Coast, a non-profit 501(c)3 organization applied the day the application went live. All of the required documents were received by the lender the same day. The application was never even submitted to the SBA by the lending. The bank does not offer any assistance at all to the borrower. Any communication is sent through email with no number or email to ask questions. Only the question and answer page is available to borrowers. This page does not address any questions or concerns. Usually when you apply for a loan at least there is a bank representative assigned to assist. It is very disappointing to know he business submitted all of the documents the day they were available and still did not get moved into the application stage.

I did see that the SBA checked my personal credit; however, I have not received a loan or any reply to my application.

Just received an email from Jeremy. Here’s what he had to share about his personal credit score and PPP.

Interesting to see this article… Citibank (or the SBA) did try to do a credit check on me personally, but it did not go through since I long ago implemented a “credit freeze” on my profile with the credit reporting agencies. This effectively blocks anyone from doing a credit check on me, and it is widely recommended as a best practice in preventing identity theft. They queried me on this, and I wrote them back a note explaining the reason for the freeze. They appear to have accepted it since they proceeded to the next step in the process (i.e. signature papers) without my having to “unfreeze” my account. But I’m not sure of this… if may yet turn out to be a problem. If it is, I just hope they let me know. Clear and timely communication on this PPP loan program is problematic.

Let me know if you have any thoughts on this.

The NPO where I serve as CEO experienced a very challenging PPP process. Neither I nor Board Chair nor Treasurer were willing to list ourselves as owners (which our bank required) and certify that this application for federal funding was true and accurate. We also were unwilling to submit to a personal credit check on behalf of the business as employee and volunteers, respectively. We have no beneficial or vested interest as we are all expendable. Not only did our bank ask for all of that, they wanted a disclosure of all personal wealth. Again, not willing to give that information for a business I (nor anyone) owns. After two weeks of calling bankers, senior staff at the bank, our Congressman and the NY Times, we got a call from a national representative to wanted to understand our concerns. My CFO and I explained each of our concerns. He then offered that we do a “paper” application via docusign which would allow us to put 0% ownership and not require a personal credit check. This happened after they received a lot of negative press… and of course, after all the funds were expended. Interestingly, a colleague from a local community bank said they required none of that (not even a credit check) for the PPP and they prioritized loans based on which were essential services. Knowing how few loans were made to small business and nonprofits is a travesty. This was yet another money grab that excluded the most vulnerable businesses. Without the PPP funds to cover payroll, we may have to make some difficult staffing decisions which will directly affect our ability to keep operating the essential services provided by our food bank to 1000s weekly – we have had a 90% increase in demand for services over the last 4 weeks. I hope this $349 Billion dollar lesson is not lost on Congress when they authorize additional funds.

Janet,

AMAZING WORK. Thank you for your courage and fearlessness. You evidently have a solid reputation within your community. CONGRATULATIONS ON RECEIVING FUNDS. We look forward to hearing from you as your organization experiences further developments.

Warmly, Jimmy LaRose

We did not get funding. We were unable to get the bank’s cooperation and submit until after the funds were all expended. They were doing damage control.

I contacted the V-P of BB&T(where my school has been doing business for 46 years as a 501(c)(3). Not only was Jeffrey Miles at home but he knew nothing of the requirements for the PPP program! He did say he needed a 1-page explanation of how paying my employees with no income coming in had impacted the school.

He also said he’d email me the forms on 4/3–the launch date of the program. Needless to say, I received nothing from him. Then I called his assistant who said to me, sorry, no money left, but you will retain your place in the queue. Now today, (20 April). before the extension of the PPP has even passed, the Bank sent me an email apologizing for not having a crystal ball, but telling me in effect, not to hold my breath for any consideration, but thanking me for being a stooge for all this time. So much for “relationship” banking. I guess I’ll call my next school Ruth’s Chris, or maybe Potbelly’s. BTW, I also wrote to Steny Hoyer and Ben Cardin about their deception and their bait-and-switch tactics, and did not even get a robo-reply.

Trudy Beddow

I heard horror stories about the process and being a teeny, tiny nonprofit I wasn’t sure we’d find a bank willing to work with us. In fact, a local Prosperity Bank handled our application and the branch President contacted me directly with questions on SATURDAY. He made sure all my documents were in order, called or texted with questions and let us know the day the press reported the money was gone that we had been approved. No personal credit checks, no hassles just GREAT service. We have not seen the funds yet, but we expect to within the next two weeks.

My NPO was with Conway National Bank over 40 years. When the PPP was announced our CEO contacted Conway National to go over the application process. At the time they had not “decided” if they were going process the PPP SBA loans. Immediately our CEO contacted South Atlantic Bank about the PPP SBA loans. In a matter of days we shifted funds from the bank we had been with for over 40 years to South Atlantic, completed the one-page application and provided the required paperwork. South Atlantic Bank processed the loan application and we received the funds a week later. Fortunately, our CEO acted quickly instead of waiting for Conway National Bank to make-up it’s mind. Unfortunately, because of the way most banks do business, so many other employers have lost their chance to provide job security for their employees.