Leverage Form 990 for Stakeholder Trust [GUIDE]

April 16, 2022How to Plan A Hybrid Fundraising Event

April 22, 2022United Way & ACLU Roped Into BLM Controversy – Bishop Redfern II

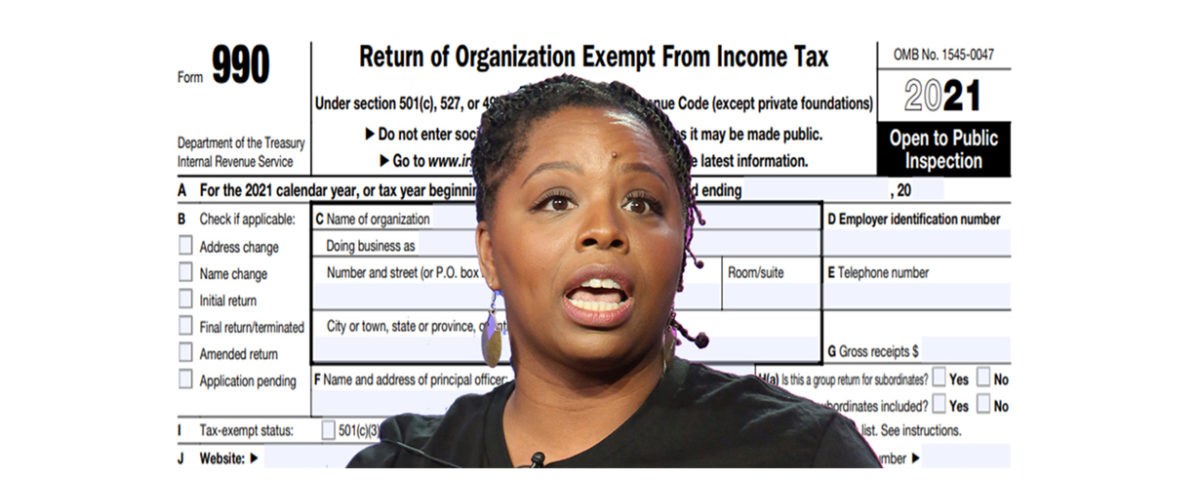

Read below a word-for-word transcript shared by Black Live Matter’s Co-Founder, Patrisse Cullors and activist Nikkita Oliver’s frustration with the IRS Form 990’s transparency requirements. Cullors and Oliver roped the United Way and ACLU (ON VIDEO) into a white supremacy racist attack against black-women-led organizations. They insist that 990 accountability has been weaponized against charities.

Here’s the transcript and video:

Nikkta Oliver: Here’s my first question. Have a new set of [Form 990] standards been unfairly placed upon [black-women-led organizations]? I want to know who’s digging into United Way’s 990s, who’s digging into these foundations who only give away 5% of their budgets a year. Who’s coming for our organizations that know we got money? Hello, ACLU. Y’all got money, but nobody’s asking for your 990s.

Patrisse Cullors: That’s right.

Nikkta Oliver: So this is an opportunity. Yes, it is a painful opportunity that comes at a cost to black-woman-led organizations being subjected to new standards.

Patrisse Cullors: That’s exactly right. It’s a good question. First of all, I didn’t [even] know what 990s were before all of this happened.

Nikkta Oliver: It’s confusing.

Patrisse Cullors: Part of the opportunity is to educate our folks. 990s are being weaponized against us. Many people don’t even know [what a 990 is] and honestly, they don’t care about [them].

Nikkta Oliver: I didn’t know about them until they started asking us for COVID-relief funds. I said, you need my 990s? Call the accountant!

Patrisse Cullors: Yeah, exactly. Yeah. The accountant handled that. It’s such a trip now to hear the word 990s I’m, like, ugh. It’s, like, triggering.

Nikkta Oliver: April 15th is next week.

United Way & ACLU Roped Into BLM Controversy – Bishop Redfern II

Patrisse Cullors: Yo, but you know what, I feel like there’s many opportunities here. It’s important to talk about why our organizations get under attack first. Why are we the first ones to be challenged? I’m not at Black Lives Matter anymore. I left last year, but for a long time we weren’t a nonprofit on purpose. We took seven years to become an actual 501(c)3. And [ever since] we’ve been under attack.

Nikkta Oliver: And I think that’s why so many folks avoid the nonprofit industrial complex. Too often we get pushed or forced into a system that’s actually meant to attack us and limit the capacity and the reach of our work? I think we have to start questioning those institutions.

Patrisse Cullors: Exactly right. This 990 structure, this nonprofit system structure, is, like, deeply unsafe. Like, this is being literally weaponized against us, against the people we work with. I can’t tell you how many people are like, am I next? Like, are they going to do this to me? Morale in an organization is so important but if the organization and the people in it are being attacked [and everything they do is being scrutinized] that leads to deep burnout, that leads to deep, like, resistance and trauma. And so, I think that there is a misinformation effort to not just challenge Black Lives Matter but [make us] an experiment. If they win then it’s the next, black-led organization, the next black person who’s leading. It’s so important that we pay attention to what’s happening, and we don’t allow [them] to create infighting, to create distrust. We have to stop it. We have to stop it before they do it. We have to shut it down. We have to be showing up against it. We have to stand back and be like, Oh, this is how it works! Like, we, are literally the experiment right now.

—END—

Your comments on this article are necessary. PLEASE WRITE BELOW FOR THE SAKE OF THE NONPROFIT SECTOR. We welcome any and all opinions!

United Way & ACLU Roped Into BLM Controversy – Bishop Redfern II was first posted at INSIDE CHARITY.

For more articles like United Way & ACLU Roped Into BLM Controversy – Bishop Redfern II VISIT HERE

About the Author:

About the Author:

Bishop Redfern II, presiding Bishop of the Ecumenical Church of Christ, is the founding Board Chair of the National Association of Nonprofit Organizations & Executives. He has been named by the Association of Fundraising Professionals (AFP) as its Volunteer Fundraiser of the Year and United Way’s Alyce Kemp-Dewitt Award Winner. Redfern, has served as the Chief Executive Officer in a diverse array of companies worldwide. He is known for his innovative leadership and management skills and a track record of providing companies with the leadership, organizational and operational tools they require for sustained profitable growth.

Patrisse Cullors was further investigated by TIMCAST.COM: https://timcast.com/news/blm-tax-filing-reveals-millions-of-dollars-in-suspicious-spending/

31 Comments

Having worked with dozens of non-profits over the past 50 years and having developed many new non-profit organizations in several different states, I have never seen anything racist about a 990 form. And this article gives no example of anything racist. It actually sounds more like another cry of “poor me, come give me more whether I deserve it or not”

Would be better to show some proof of wrong-doing. Please don’t publish a complaint without facts!

The 990 is not at all an effort to discriminate against BLM. It is an IRS reporting requirement for all non-profits. My view it also serves to inform the donors and IRS of compliance with non-profit financial duties and regulations with regard to expenditures.

I agree with George. The 990’s are a requirement of all nonprofits as a form of IRS reporting. It has nothing to do with ethnicity, it has to do with being above board and simply reporting on received funding and funding obligations. We also follow with audits to be totally transparent. We post them on our websites although we are only required to make our 990’s available. We have nothing to hide. When I look at 990’s or any charity I work with it is to make sure they too are being compliant. Since we are all now required to file some form of 990, when a charity has never filed and yet their post 1969 determination letter declares they are required to file once their income level is at $25,000 or more in a year for more than 25 years, that is a red flag. Since when, has compliance of all nonprofits discriminatory? Charities that were created before 1969 with a basic single paragraph determination letter without a lot of instruction or guidance to it, later received what was referred to as the “Post 1969” Determination letter explaining in detail much of their obligations to include for example “Once your income level is $25,000 or greater in a year you are required to file a 990. However, many were ignoring that practice and signing off declaring their income was less than $25,000 while it was often $1M or more than $2.5M. I experienced this personally with no less than probably 100 charities over the course of the first 5 or so years I worked here. When I would call them after seeing their budget, I would request a copy of their 990 and they said they did not file one and had never but their income level that was at or higher than the required amount to file had been such for sometimes 25 years or more. I had to inform them that they would not be considered and were in violation. After 9-11, the nonprofit division of the IRS separated, I believe because there were so many charities that they themselves had not done the proper due diligence in confirming their income levels and they also found many terrorist cells being supported through some of these entities changing their practices and after the Pension and Protection Act was signed into order everyone was then required to file some form of 990 whether it be a post card or full detailed documentation. In the media blast around that time it was announced that over 30,000 charities would be receiving their revocation notification for not filing their 990 when required to for more than three years. The actual numbers were that year 287,000 revocation notifications for not filing for 3 years or more and the following year was over 282,000 revocation notifications went out. They explained to me that the reason they gave diluted information to the media was “they did not want people to lose faith in their charities.” My question to them is would people lose faith in their charities or hold them to a higher standard? The 990’s are an informational document we all file whether we are a charitable foundation or a charity recipient. It has nothing to do with bigotry. Bigotry is when one provides preferential treatment to one over another but since we are all obligated there is no preferential treatment. Moot point.

Not discriminations against BLM. It is a requirement of ALL non-profits to inform of their sources and uses of donated funds.

What is the problem with a non-profit reporting how it spends donated money? The same argument is used by politicians when they are caught using campaign donations for personal indulgences.

Isn’t the issue that media, critics, funders are scrutinizing the 990’s

of Black-led organizations in a way they are not doing for non-BIPOC orgs? To use this publicly available, required tax form that is standard for all non-profits, to investigate, spin stories, and disparage in order to delegitimize and undermine the work of BLM and other Black-lead orgs?

Is that the issue? or is this how this organization is responding to the same scrutiny all Non-profits have had to manage through since 1941? Please share the facts about additional scrutiny. For I will support BLM in this argument if it were proven to be true. I’ve only read accusations of unique scrutiny to date.

As a Non-profit professional, I have been asked many times to share our Form 990 and/or present to large donors directly and answer the questions: “What are you doing with my donation? What impact did you have on the mission I gave you money to support? What are the successes and challenges with the programs your are implementing with my support?

Form 990 is to Non-profits what Annual Shareholder meetings are to For-profits.

Negligence is not a successful long-term strategy: “I didn’t even know what a Form 990 was before all this….. ” How did you become a non-profit and NOT?

Also as a founder of a nonprofit since 2005 and also its current CEO, we have had to submit 990s since the beginning. Even today though our annual donations are below $50,000 we are required by law have to submit a 990N each year by May 15th, which we do. It is well published by the IRS and legit tax preparers are well aware of the 990 requirements. Not sure what this lady’s issue is since their Board and CEO or Executive Director should be well aware of. Even as a small organization, many times we have to prepare what is called a Pro Forma 990 involving applications for grant funding. Course the more monies a 501c3 nonprofit public charity receives then besides filing the appropriate 990 form, organizations must have an official audit of all records on an annual basis. Everything about IRS regulations related to charities and nonprofits are available on the IRS website (https://www.irs.gov/charities-and-nonprofits). I’ve not seen any discrimination toward our sector except when the IRS was stalling approvals of political related organizations in 2009 and 2010.

I guess the point about not knowing anything about 990’s makes you wonder why and how they started a non-profit to begin with. That makes it sound like they have no idea what they’re doing. Do they have a bookkeeper, a Treasurer, or a CPA giving oversight? Getting a non-profit to the point of being official is a lot of work, with plenty of places to go off track. There’s a lot of fraud in non-profit land. People go to prison for doing things, or not doing things, correctly. These ladies need help before they end up in prison through their ignorance.

Really? Cullors and crew create and operate a non-profit that supposedly takes in $90 million but the last 990 (EZ) filed by Black LIves Matter (EIN 82-4862489) was back in their heyday of 2019. Odd that 990 shows ZERO income, ZERO gifts, ZERO donations and ZERO compensation for Ms. Cullors and her office manager. And they wonder why the IRS is curious about your organization and its management? Similar to the interview above that sounds like total B.S..

They are complaining about being transparent about what any public charity, exempt from taxes, needs to explain about how they spend the public’s money. The 990 is a form that all non-profits have to complete, there are no “special requirements” based on race or gender. I’ve completed them and audited dozens of them for many non-profits. They are all the same and they ask no racist questions. What are the BLM managers trying to hide?

The fact that you start a non-profit yet don’t know what a 990 is suggests you maybe had no intention of operating as a non-profit but rather a cash machine to manage like a personal income/business? It’s called accountability. We ALL have to fill them out.

Patrice, put your big girl pants on and follow the law like the rest of us.

Having served the nonprofit sector as a senior development officer and fundraising consultant for 38 years, I know the value of the 990 form. In addition to encouraging sound management principles and providing institutional information, It ensures donors complete transparency for decisions related to philanthropy. Anyone opposing the use and value of requiring 990s for nonprofit organizations is either uninformed, misinformed, or just trying to deflect from the lack of good management, or possible the misuse of donor funding.

The 990 Form is simply an accountability form…if you as a Nonprofit take in donations (monies), with the implied intent of “helping” a community…any community, then you should be transparent with how you handle those donations…you OWE it to the donators to show where/how their donations are being used. To point at The United Way or the ACLU and accuse them of being “racist” is simply the art of misdirection…”look over there…not over here”. If you cannot in good faith share what, why and how you are using donations…then there is a MUCH larger problem. Would it not be better, if you are indeed doing everything above board…to simply fill out the form and share how you manage donations. This is not just about BLM…it is about ALL Nonprofits…all Nonprofits are required to be transparent.

A not-for-profit that has been granted its (501-c-3) status from the IRS is required to file a Form 990 annually. Why? Because there are regulations that NPOs must adhere to. Because they are not required to pay tax on their income and the because the IRS must ensure that the organization is still eligible to hold its 501-c-3 They must show that they are providing a benefit for the public. They must show the source of their income and who their largest donors are. Finally, they are required to make their 990s available to anyone who asks for it. Any person can make this request and 990s are even available online. Why? NPO’s must be accountable to the public. Many/most NPOs are asked for their 990s from time to time.

None of this has anything to do with race, discrimination or politics.

Pat, the editors at InsideCharity.org appreciate and agree with your perspective. Thank You.

What a waste of time listening to two women who evidently do not understand tax law, or, IRS Form 990, in this country, and who have been given an opportunity to demonstrate what little they know about a non-profit business.

William, the editors at InsideCharity.org appreciate and agree with your view. Thank You.

It is a privilege to receive “tax-exempt” status, not a right. You abide by IRS and State rules and laws on transparency, governance, and charitable mission because you are subsidized by the government (i.e. taxpayers). The cash you received is not YOUR money! It is taxpayer’s money to perform charitable endeavors. It is ridiculous you think that taxpayers and donors should look the other way and not question what you do with OUR money! If you don’t want transparency then file a as for-profit entity and pay taxes. That is also your right. Stop using nonsense and wokeness to cover your deceit. Obey the rules and laws like the rest of the millions of nonprofits that are doing the right thing.

Since the SOX Act of 2002, the 990 has been about more than financial accountability and transparency. Proper board conduct, whistleblower polices, internal control assessment, conflict of interest requirements, rules against retaliation … all these are in response to the Enron debacle. Above all, a non-profit should welcome accountability and calls for transparency. After all, at the end of the day, our reputation is all we have.

You simply canNOT make the assertion that United Way and ACLU are not racist because their history of discrimination toward employees and racist policies is clear. However, the racism is not tied to the transparency of their Form 990s. You’re missing a larger point here, which is that Form 990s are an aid in transparency. This is true. It is also true that some organizations are targeted by opposition attacks using 990s; RoadMap Consulting has an entire program dedicated to protecting organizations from such attacks. Both things can be true at once. The real question is whether this is what is happening with Cullors. Because BLM chapters across the country and other movement organizers, that is Black people, have been asking for financial transparency long before you noted it. That is separate from the clear racism that has been enacted by the United Way and ACLU over the years and currently. And we should be looking at how financial information and government forms are a problem of inequity for many organizations. Most likely not in this case, but it would behoove Inside Charity to develop some cultural competence and cultural humility so that you have a deeper understanding, rather than conflating all of the issues together as Cullors is doing.

Kebo, we value your opinion. Thank you for spending your valuable time investing in our readers.

In regards to:

“United Way & ACLU Roped Into BLM Controversy”

It was and IS all a CAPER, they founded a fictitious “caring” cause” and “organization” NEVER were concerned about “BLACK LIVES”…

I am a Man OF Color and I can boldly state and say that “it NEVER WAS about BLACK LIVES”…it was about THEIR lives! The problem NOW is that they got caught with their hands in the cookie jar! The donations that came in were from people who really DID wants to support the cause of people of color and their struggles, and as those women took IN the donations, other people from the other charters of “BLM” were quitting and complaining that the chapters THEY were over weren’t seeing ANYTHING that were coming IN. Those that stepped down and quit KNEW that it was only going to be a matter of time, before those women got caught! Woman, sitting on the right in the video, claimed that she “didn’t know about them,[990s) until they started asking us for COVID-relief funds”, and she ALSO said that she “didn’t [even] know what 990s were before all of this happened”…now, if THAT is SO, then how can she build an argument ON the subject and try so hard, NOW, to say “this is an opportunity. Yes, it is a painful opportunity that comes at a cost to black-woman-led organizations being subjected to new standards”…so, MY question is “how can she be ARTICULATE on a subject that she DOESN’T know about”? She seems to “UNDERSTAND” that “this” is an “attack” “unfairly placed upon [black-women-led organizations]”,(according to HER)…It is very important to notice that people who are OUT to deceive are very KNOWLEDGEABLE in the AREAS that they TRY to deceive people, or systems IN.

I am on The Lord’s side. I care about people…this land…AMERICA. I am NOT into “political parties”, I am into POLICY. WHOEVER is speaking in agreement with The Holy Bible and whoever is caring about THIS NATION and the people IN it, is who I am siding with. The present administration is NOT caring about this nation NOR the benefit of the people IN it…I sit in the seat, as you would when watching a movie…I don’t watch it with a SET MIND,I watch it so that I can “SEE” what’s going on. I watch the WHOLE picture…What I “see” is total corruption…what I am Blessed to “SEE” (Discern) makes GOOD SERMON TITLES AND SUBJECTS,(yes, I am a TEACHER of God’s Holy Word, and that is where MY TRUST IS! I “SEE” (Discern) children being misled and even targeted. Pretty soon, the CONSTITUTION will be honored again…and God will get The Glory! Until then, you have people like this lady and her co-horts, who claim BLACK LIVES MATTER, but that’s NOT what they mean…. This nation needs to pray to The God of Heaven…in Jesus’ Name…Amen. Thank you for the opportunity to SHARE FREE though and FREE SPEECH… THAT is how it SHOULD be! ~ (excuse any typos if there are any).

Amen to my brother in Christ!

As a founder of a nonprofit since 2000 and also its current Executive Director/CEO, we have had to submit 990s since the beginning. Even though our annual donations are only $150,000 we are required by law to submit a 990 each year by May 15th, which we do. It is well published by the IRS and legitimate tax preparers are well aware of the 990 requirements. We are proud to publish our 990’s on our website for the whole world to see.

It is an interesting allegation that the requirements that 1.5 million non-profit organizations follow faithfully are somehow being used against only this lady. Transparency and accountability are essential to the trust of people donating money – if there was no potential for deep scrutiny there would be no real trust. We all know that over the years there have been many non-profits that have been held accountable by the press and the public and the guilty exposed – regardless of race. If you have nothing to hide then the press and others are not going to have a platform to attack you. If you have something to hide, then I say bring on the heat. Con artists and pretenders only make the job harder for the 99% who follow the rules.

“Some of us are thought to be fools – others open their mouth and remove all doubt”

This statement is due to a lack of knowledge. I am an African American that has run various type of nonprofit organizations and provide organizational development training to nonprofit organizations. If they only read for understanding and also read the United Way of America case with CEO Arimony and other United Way chapters that had cases of misappropriation of funds, it would greatly enlighten their awareness. Why are there individuals that think they are entitled to donor support and have no responsibility to let these generous individuals know that their donation was spent for the purpose intended at a reasonable percentage. To think otherwise and state this is racist is absolutely ludacrist!!!!

perfect answer! thanks

Is there anything that ISN’T “racist” anymore? Just another poorly disguised attempt to inflame and generate yet another on-line outrage fiesta.

I had zero experience in the non-profit sector or bookkeeping. When I opened my non-profit, it was my duty as a founder to do the research on compliance with the IRS and state like every non-profit before me. We are held to a higher standard of transparency when you are using donors’ monies. Every non-profit is required to file their 990 annually just as for-profit businesses have to file their taxes. So, have they not filed any tax forms? Why do they feel exempt from showing accountability? Do their donors not have the right to see where their money is going? What are their salaries? 990s can be very confusing but there are plenty of resources out there right at your fingertips.

This is insanity. if a black woman is leading a charity I expect the money to go to the charity, just as I would if a white woman ran it. I am tired of being fleeced for donations, the same thing happened to a pit bull charity i was donating too also. 5 percent of the money got to helping the pups. No white person or black person should be getting wealthy off a non profit.

[…] trouble because their financial management is poor and subject to corruption, as defined by law. Just take a look at the Black Lives Matter issues that have recently surfaced. Some of their chapters are now being closed down by state authorities. (CCF is advocating and […]

I’m surprised to see no mention of Candace Owen’s film documentary on what happened to BLM. She does a “follow-the-money” investigation with a film crew and comes up with a fine piece of investigative journalism that gives opportunity to both sides (she visits the co-founder’s new residence – or one of them). It’s called The Greatest Lie Ever Sold, and you won’t hear much on mainstream media about it because so many people got duped who are supposed to be today’s value-casting thought leaders, and the truth doesn’t fit their (current) “narrative.”